NRG’s former CEO David Crane wrote a very thought-provoking piece on how it is never easy for traditional non-green companies such as that of a coal company to become green overnight. The company recently announced a divestment from renewable assets, as well as a sale of their renewable business arm. This is a cold and cruel reminder for all of us on the realities and difficulties of change in profit-driven businesses, regardless of how good the intention for change is.

NRG’s capital allocation strategy — reinvesting coal profits into clean energy businesses — fell into disfavor with NRG’s traditional investor base. – Crane

Back in 2014 when Crane was still onboard, he pushed for green goals of steering the business towards a less carbon-focused energy portfolio, in proportions as astounding as 90% carbon reductions by 2050. Many employees were excited by this green revolution and were extremely motivated by the notion of doing good while doing well. The management painted a very rosy picture of how businesses can keep improving whilst switching to cleaner alternatives. Sure enough, the board was sold. They started to publicly announce the transition to cleaner energy.

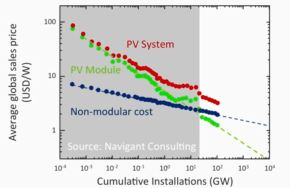

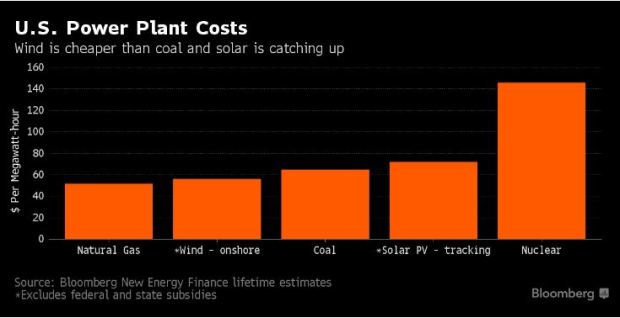

But not long after this shift to renewable energies, share prices dipped and investors started to turn their backs. The board thus had no choice but to salvage the situation by abandoning ship. One of the main reasons why investors had lost faith so quickly is because they are only focused on short to at best, medium-term profits. This goes entirely against the tide of the renewable energy business where profits precipitate more towards the end of a longer term.

This is also one of the road blocks that companies like Solar City will face in their pursuit for green energy. In the short-term, finance reports will start to look less attractive when, for example, solar projects do not generate quick returns by running a zero-down payment model. Then it seems to turn into a self-fulfilling prophecy. Investors start becoming apprehensive which in turn hurts the business potential.

If we are going to make meaningful progress on carbon emissions, chronic emitters cannot be given a free pass simply because they have announced long-term reduction goals. If we are to maintain the integrity of the collective corporate effort, the climate movement needs to demand visible and meaningful progress from companies that have embraced long-term carbon reduction goals.

An important point for the transition to green business models is this: to understand and portray the full value of the transition to sustainable business by laying out a clear picture of costs and benefits of doing so. That is why sustainability reporting and more importantly, integrated reporting where investors see a full picture of risks and opportunities is crucial. Investors, on the other hand, ought to also be educated on how to invest and where to invest. Although NRG investors can cheer for now, their joy may not last beyond the decade or even the next few years.

NRG’s return to their old dirty coal business, in the mean time, serves as a harrowing wake-up call for us to reflect on the realities of chasing after green dreams and whether we are truly resolute with our green targets in the face of challenges and road blocks.